Real Estate Investing Is Boring!

Recently, the stock market has been in correction territory and Canadians are nervous to look at their upcoming portfolio statements which will show major declines. This is not the financial crisis of 2007-2008 but another hit to the overall wealth of Canadians.

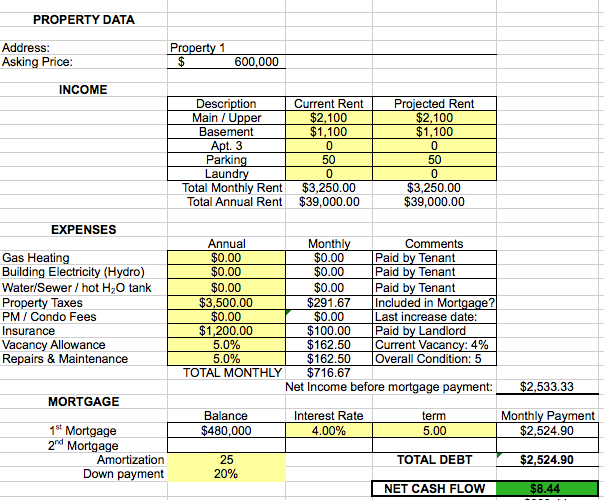

The stock market (stocks, mutual funds, index funds.....) is one to way to invest. Another alternative to consider, a boring option would be an investment property. Here is a scenario for buying ONE investment property in Toronto and holding onto it for 25 years prior to selling it.

Assuming average interest rates over 25 years of 4% and allocating 10% for vacancy, repairs and maintenance the investment property breaks even, i.e, no cash flow is generated on a monthly basis. What would the numbers look like after 25 years assuming an appreciation in line with inflation at 2%? Here is the outcome:

- Property value: $984,364 ($935,148 after 5% selling fees)

- Return on Investment: ($935,148-$138,400)/$138,400 =575.7% or 23% annually

- Assuming 1% rental income increase annually, gross rental income is $4,168

Investing in real estate is boring as it takes time to payoff an investment property and to reap the rewards. Investment diversification is key and not putting all eggs in the stock market basket can provide some peace of mind and better sleep.

How would $935,148 contribute to your retirement goals? Imagine the freedom of having TWO paid off investment properties.

Questions? We can be reached via email or social media.