Thinking of investing in real estate? Before you put an offer, find out about the 10 commandments of real estate investing

You Don't Have To Be A Walmart Greeter!

What Should You Do With Your Investment Property Cash Flow?

Im Buying an investment property is similar to buying a business; it needs to cash flow. Would you buy a business that loses money on a monthly basis? Probably not and you shouldn't buy an investment property that negative cash flows.

Now that we agree cash flow is critical, what should you do with the monthly cash flow surplus?

Let's assume the property cash flows after expenses and reserve fund allocation, $500. We encourage our clients to allocate a minimum of 8% of rental income for repairs, maintenance and vacancy allowance. For a property that generates $3,500 monthly, $280 is set aside.

There are 2 options to consider for the net $500 monthly cash flow:

1. Prepay investment property mortgage

2. Prepay principal residence mortgage

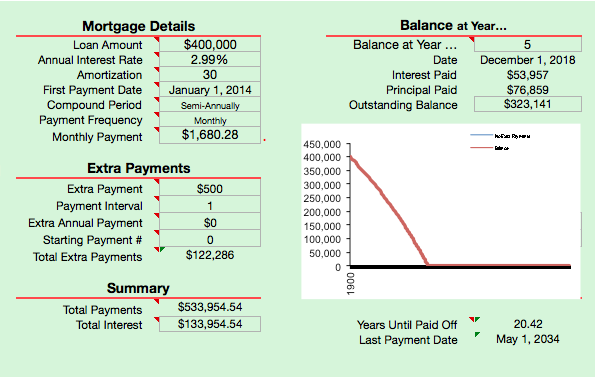

Assume your principal residence mortgage balance is $400,000 borrowed at 2.99% and amortized over 30 years with a monthly payment of $1,680.28. By diverting $500 monthly into your principal residence, the mortgage amortization is reduced to 20.42 from 30 years, saving you 9.6 years or $193,568 of mortgage payments.

Imagine having no mortgage payment!

Another factor to consider is tax efficiency (disclaimer: consult a professional accountant for tax advice, we are not accountants). The interest portion of a principal residence mortgage, for majority of homeowners, is not tax deductible. Whereas the interest portion of the investment property mortgage is tax deductible. A sound financial strategy is to pay off non tax deductible debt first.

Once the principal residence mortgage is paid off, use the rental property surplus to pay down the investment property mortgage to increase cash flow and pay it off ahead of the original amortization.

Questions? We can be reached via email or social media.

Flip The House.....Later

Buying a house, doing some work to it and selling it for $100,000 profit a few months later sounds like a lucrative proposition, but is it really?

Canada Revenue Agency will tax the profit as income not capital gains. In this instance, the full $100,000 profit would be taxed at your marginal tax rate.

Here is an example of why I prefer to flip the house.....later: Buy, Add Value, Refinance (BAR) then hold

Buy & Add Value

- Property purchase price $500,000

- Downpayment, closing costs & 4 month carrying costs: $113,000

- Renovations: $100,000

Refinance

- Refinance property at $600,000

- New Mortgage (80% of value): $480,000

- Total Capital (including closing costs): $144,609

Hold

- Hold property for 5 years

- Annual appreciation: 3%

- Annual ROI w/ cash flow: 18.55%

- Property equity after 5 years: $237,438

If property is sold after 5 years, only 50% will be taxed at your marginal tax rate. Assuming a sale price of $675,000, only $87,500 out of the $175,000 ($675,000-$500,000 divided by 2) would be taxed at your marginal tax rate. Disclaimer: Always consult a professional accountant who specializes in real estate investment to guide you through CRA's rules and regulations. Capital Costs Allowance are not taken into consideration in this example.

To summarize the 2 options:

1. Sell Now: $100,000 profit taxed at marginal rate

2. Sell in 5 Years: $237,438 profit (difference between property value and remaining mortgage balance) plus $41,588 in cash flow over 5 years, only $87,500 taxed at marginal tax rate

Advanced real estate investor tip: Don't sell the property after 5 years, refinance it to pull equity to buy another investment property which would defer paying capital gains taxes to a future date and build portfolio by acquiring another investment property.

To answer your questions or to put your financial freedom plan, we can be reached via email or social media.

Paydown Investment Property Or Access Equity?

You bought an investment property 5 years ago and it's time to renew the mortgage. Should you renew the mortgage or refinance to pull equity to buy another investment property? This is a common question we get from our investor clients (This question is applicable to your home mortgage as well).

Here is an example to best illustrate the options:

Current Property Value: $720,000

Mortgage Balance: $465,000

Option 1 - Pull Equity to 80%: new mortgage $576,000 amortized over 35 years. Access $111,000 of equity to acquire another investment property (35 year amortization is available for investment properties)

Option 2 - Renew mortgage at current remaining amortization and mortgage balance remains unchanged at $465,000

If the real estate investor is in acquisition phase, it is best to proceed with option 1. This also provides a tax advantage; the interest costs for the additional $111,000 are tax deductible since it is used for investment purposes (disclaimer: consult an accounting professional for tax advice). A key point to consider when deciding how much equity to pull out of the investment property is to stress test the cash flow using higher interest rates to ensure the investment property will not negative cash flow in the future.

If the real estate investor has completed acquiring the number of properties required per the plan, it is best to proceed with option 2 to pay off the investment properties and increase passive income.

Having a plan upfront helps you, the real estate investor, in knowing how many properties are required to achieve your long term financial goals and deciding what to do at mortgage renewal time.

Questions? We can be reached via email or social media.

How Many Investment Properties Do You Need?

Over the years working with real estate investors, I have come across very interesting answers when I ask "How many investment properties do you need to buy?" I have heard from 1 property to 40 properties, 1 every year for the next 5 years, don't know... Most stumble when I ask why? It starts with why. Simon Sinek explains the importance of starting with why in his TED Talk

There are many reasons for buying investment properties, here are some:

- Retirement income

- Fund children's post secondary education

- Job replacement (one spouse might be considering leaving their job)

- Supplemental income

- Family legacy

- Full time real estate investor

- Investment diversification (real estate and stock market)

Once a reason or multiple reasons are chosen, determining how much monthly income the investment properties are to generate is the next step. This goal can be achieved via different investment properties options (single family, duplex, multi-family, commercial....) and various geographic locations.

To complete "why invest in real estate" analysis, reverse Engineer the number of properties you need and have your personalized "how and where" plan developed, click here.