There has been lots of talk about interest rates not moving up for the next year or two. But mortgage rates are up already!There are two types of mortgage products: fixed rate and variable rate. Variable mortgages are based off prime rate which is set by Bank of Canada's benchmark rate, whereas fixed mortgages are based off bond yields. As per the Bank of Canada's most recent announcement, the benchmark mark rate remained unchanged which effectively left all variable mortgages, HELOCs and unsecured lines of credit unchanged. However, the bond market has experienced a sharp increase in yields which pushed fixed mortgage rates higher.

Variable Mortgage Rates

Bank of Canada's benchmark rate is a tool to control inflation around the 2% level. As inflation creeps up, the Bank of Canada increases its benchmark rate to slow down spending due to the higher costs of borrowing. On the other hand, when the economy contracts (recession), the Bank of Canada reduces its benchmark rate to stimulate spending and economic growth. Currently, Canada is in a stable inflationary period, therefore the prime rate has not changed for a few years and should remain close to the 3% level in the near future.

Fixed Mortgage Rates

You might be wondering, why did fixed mortgage rates move while prime rate did not?

The bond market movements are influenced by good or bad economic news. Good economic news result in money moving from the bond market, which offers low returns since it is considered a secure investment, into the stock market for higher returns. For the bond market to be attractive for investors, yields increase. As yields increase, fixed mortgage rates increase. Good economic news such as job creation, GDP growth, improved housing numbers result in upward pressure on bond yields and fixed interest rates. The US economy has been showing signs of improvement which caused the recent increase in fixed mortgage rates.

There you have it, now you know why fixed mortgage rates have increased and variable mortgages have not.

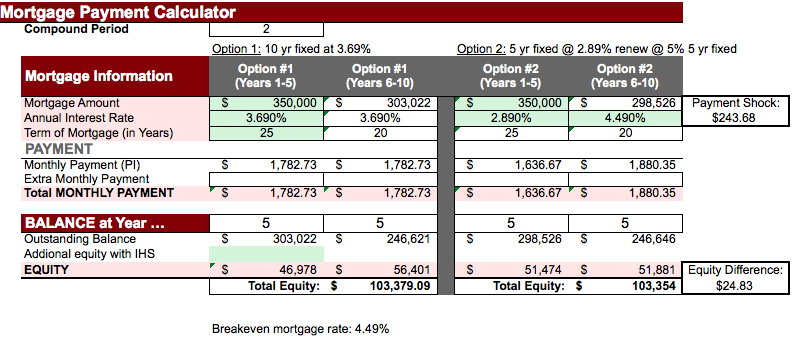

With the recent 5 year mortgage rates increase, the difference between 5 year and 10 year fixed mortgages is at an all time low, is it time to rethink the 10 year fixed mortgage strategy?