I have to share this personal experience since it resembles what I deal with on a daily basis with my mortgage clients.My home and auto insurance policies have been with a company for years now until I got my renewal letter a few weeks ago. The jump in insurance premium caught my attention especially since my wife and I are responsible drivers: we have 2 young children, and our records have been impeccable; no tickets, no violations, no accidents.....Usually I get my renewal, go through it to ensure there aren't major changes, the price is reasonable based on the previous premium and then renew.

Sounds familiar? You get your mortgage renewal, too busy with kids, work and life, numbers look ok and you renew? I wasn't happy with the increase in premium and decided to look around.

I tried a price comparison site which provided a low price but after connecting with the insurance company it turned out the information transferred to them from the rate site was inaccurate and the quoted price was invalid; it was higher.

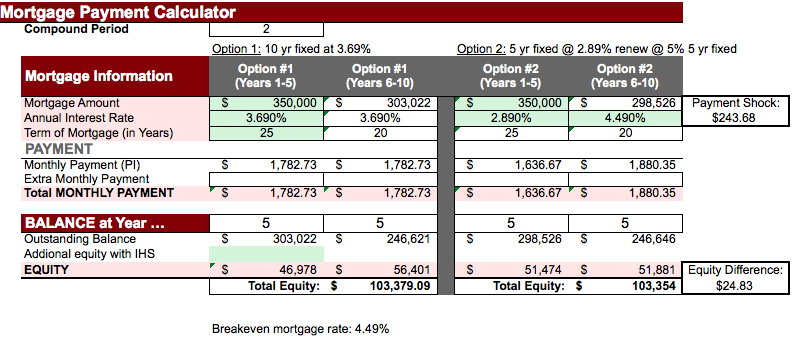

Sounds familiar? You check out a mortgage rate site to find out the rates being quoted are for 30 day closings, have restrictive conditions, not valid for rental properties, you can't refinance the mortgage in the future.....and the list goes on.

By investing some time I saved 25% off what was offered by the existing insurance company.

3 Mortgage Renewal Tips

- Don't sign the renewal letter sent by your incumbent lender

- Rate sites provide a number but don't tell the full story

- Take the time to consult with a professional, it could save you thousands of dollars

In my business, new and repeat clients are provided with superior service and their business is never taken for granted. I don't understand why some businesses take their existing clients for granted.

If your mortgage is up for renewal, you don't want to be taken for granted and looking for professional unbiased advice, please contact me.