Just when I think mortgage rates won't get any lower, they drop. With real estate sales volume slowing down across Canada and lots of bad economic news globally, mortgage rates have hit an all time low for 5 year fixed and 10 year fixed mortgages. The battle of 5 year versus 10 year fixed mortgage is back!

5 Or 10 Year Fixed Mortgage

How do you choose which product makes sense? Per Bank of Canada, average 5 year posted rate for the last 10 years is 6%. It wasn't too long ago, in 2007 and 2008 5 year discounted mortgages were at 5.79%-5.99%.

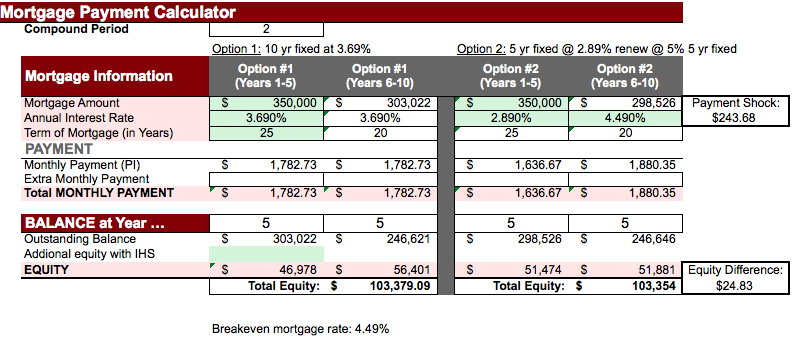

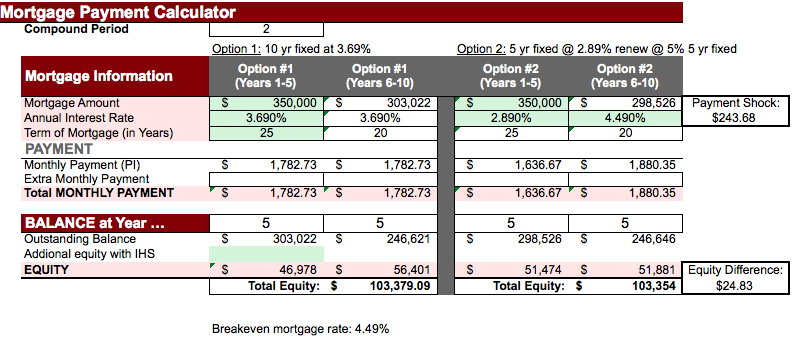

Let's look at data to analyze which option makes sense by calculating the break even mortgage rate:

- Mortgage balance: $350,000

- Mortgage Amortization: 25 years

- Compare 5 year fixed mortgage at 2.89% versus 10 year fixed at 3.69%

What the abort chart shows is if one selects a 10 year fixed mortgage, sets the payment and forgets about it for a 10 year period versus choosing 2 5 year fixed mortgage terms, the breakeven mortgage rate is 4.49%. If one believes that mortgage rates will be higher than 4.49% in 5 years from now, the 10 year fixed mortgage option makes more sense, or if one believes that rates will be lower than 4.49% in 5 years from now, the 2 5 year fixed mortgage terms option makes more sense.

BUT, as a mortgage professional, my clients don't get away with setting the mortgage and forgetting about it. Utilizing the inflation hedge mortgage strategy, pro-actively managing the mortgage and adjusting the payments for inflation, the breakeven mortgage rate drops to 4.35%. The inflation hedge mortgage strategy protects the homeowner from payment shock when renewing at higher mortgage rates and reduces mortgage amortization by achieving mortgage freedom earlier.

Understanding historical interest rates data and the breakeven mortgage analysis, the decision of choosing 5 year fixed mortgage or 10 year fixed mortgage should be an easier one.

Disclosure

- The breakeven mortgage rate will vary depending on mortgage amount and amortization.

- Above mortgage products are fully portable, assumable and have 20% pre-payment and 20% increased payment privileges built into them.

- Above mortgage products can be ported to a new property and mortgage amount can increased which is known as port, increase & blend in the mortgage broker world. This is important feature since it would be a bad mistake to break these low rate mortgages in the next 3-5 years if one decides to move.

- 10 year fixed mortgage penalty the day after 5 year anniversary is 3 month interest (not interest rate differential) per Interest Act.

To run your personal mortgage breakeven analysis, please contact Nawar.