In today's do it yourself world from DIY renovations, DIY buying & selling homes, DIY investing, DIY looking for the lowest mortgage rate....is this the end of mortgage brokers?

Recently there have been a few articles in the media regarding mortgage brokers and banks:

As a mortgage broker, believe it or not, I am arguing for the need of a mortgage professional arranging the financing for a homeowner for the following reasons:

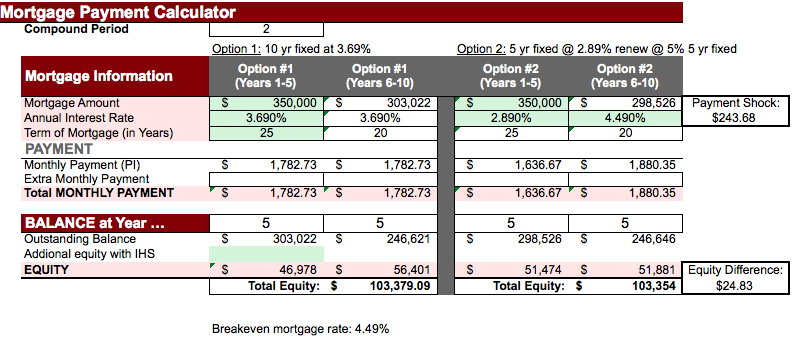

Mortgage Options

A mortgage professional provides different mortgage products and options to suite homeowners' needs. Here are 3 examples:

1. Young Family

A couple are expecting children and their income will be reduced to one income, cash flow is important for them in the near future. Hence, a mortgage product with 35 year amortization would be beneficial with generous pre-payment and increased payment options to help them catch up once they go back to two incomes.

2. First Time Home Buyer & Real Estate Investor

First time home buyers buying with 5% downpayment but have the intention of renting their existing home in 4-5 years time frame once they move up the homeownership ladder. A good option to consider is a 10 year fixed mortgage to set the cost of borrowing and eliminate the need for the first time home buyers to requalify their first home as a rental property in 5 years time frame at higher interest rates which would restrict their ability to qualify for their next home.

3. Business Owner

Self employed who wants to access their home equity as they pay down the mortgage without the hassle of qualifying. An option to consider is a re-advanceable mortgage where as the mortgage principal is paid down, the secured line of credit increases by the paid principal amount providing additional secured equity if needed by the homeowner

Clearly, one size does not fit all. 5 year mortgage term is the most recommended product, I wonder why?

Mortgage Terms & Fine Print

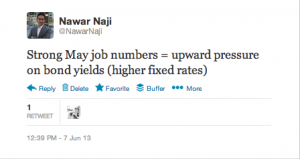

This is very important since I believe the majority of homeowners sign without really knowing what they are signing for. Per the article mentioned above (Client uses Twitter to Challenge TD Bank), it is probable the client didn't know what the mortgage restrictions (penalties) were. Either he didn't ask or the mortgage professional did not explain the details. Many homeowners focus on lowest rate (What's Your Lowest Rate?) without considering the mortgage product fine print which could cost them thousands of dollars on the back end. This is a result of confusing lowest rate as saving money.

Mortgage Strategy

When choosing a financial planner or advisor, one wouldn't choose based on the price of mutual fund or stock on that specific day, they would choose based on the plan they provide and one's belief in the planner's ability to execute the plan. As for mortgages, a homeowner gets a quote, signs the paperwork and doesn't hear till mortgage renewal time or they might they get an offer for a credit card, mutual fund or chequing account in the mail. Why would a homeowner choose their asset advisor any different from their debt advisor? What separates the true mortgage professional from the "application filler and rate quoter" is providing a sound strategy to help the homeowner achieve their financial goals. One wouldn't give a financial planner $50,000 and talk them after 5 years, so why would one borrow hundreds of thousands of dollars and not expect a proactive approach?

Professional Mortgage Brokers

I hope I have laid out the case why mortgage brokers are needed. A word of caution: there are good and bad mortgage brokers. To find a mortgage professional ask lots of questions of the mortgage broker or banker regarding the mortgage options, terms, fine print and strategy. To get a copy of the 4 questions one should ask when shopping around for a mortgage, go to: Shopping Around Questions

If you are looking for a professional mortgage broker whether you are buying a home, an investment property or renewing a mortgage, please contact Nawar.